Technical Consulting

With lab and field scale evaluation, reservoir simulation, static geo-modeling and dynamic simulation, economic valuation and modeling, including production optimization, drilling consulting, application development, and education and training … XYCENE has ALL the necessary licenses to operate in these capacities in Nigeria.

Our ongoing projects include (1) subsurface consulting on fields in Nigeria for a major multi-national operator, conducting reservoir characterization, static and dynamic modeling, and field development planning scenarios, and (2) active litigation consulting for a number of cases involving domestic and multi-national operators and federal governments, with damages approaching $1 Billion. Although, we cannot share more information on confidential projects, feel free to browse some of our past projects.

BROWSE SOME OF OUR TECHNICAL CONSULTING PROJECTS

GBOKODA STUDY

Nigeria

-

Validate the estimate of STOIIP, understand sources of water production and its impact on est. remaining volumes, and validate new drills.

-

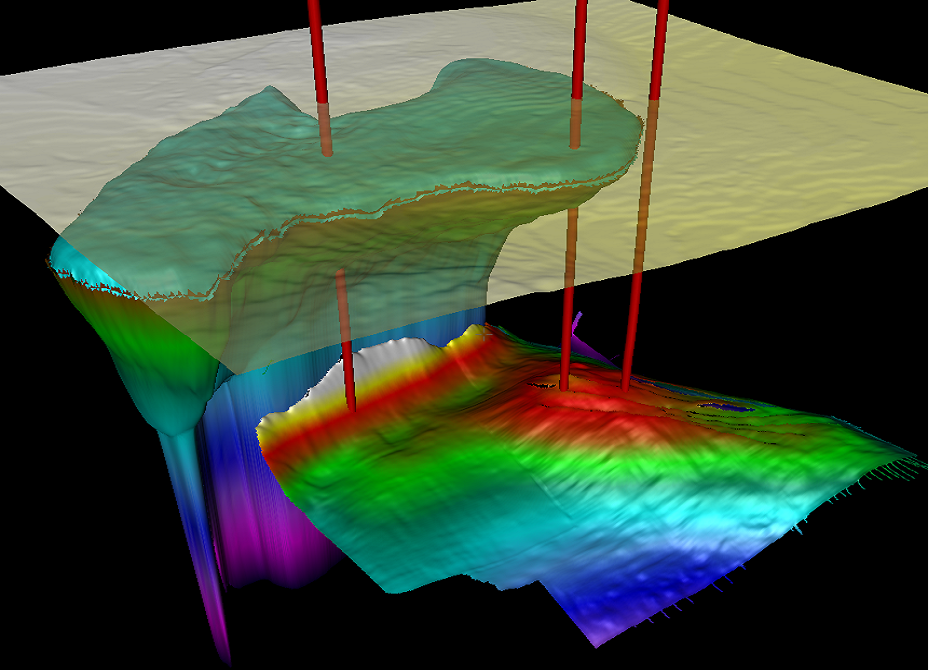

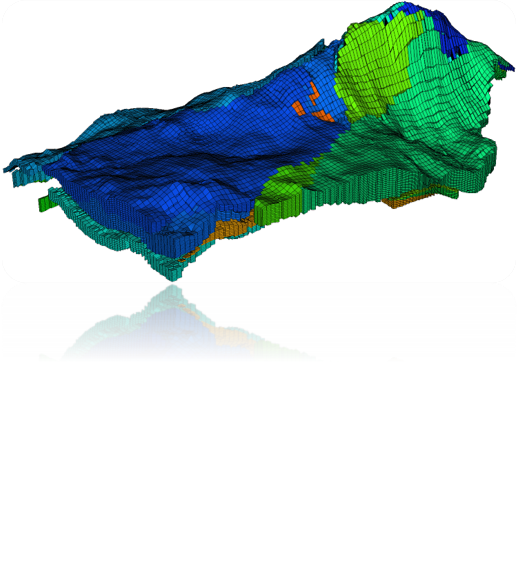

Integrated project team with geology, geophysics, reservoir disciplines performing Reservoir Characterization, Static Modeling, and Dynamic Simulation.

-

Successfully developed 3D static model, then transformed to a dynamic model, initialized, and successfully history matched. Subsequently, this dynamic model was used to make several production prediction cases for asset.

Our subsurface consulting on this project has provided Chevron with ...

A near-term development option with suggestions on workover activities and water injection strategies.

A mid/long term development option detailing location and predictions with drilling an additional new producer, as well as water injection strategies and other field development plans.

CONFIDENCE in Chevron’s partnership with Xycene and successful continuation onto future subsurface consulting projects (including a study currently running during 2022).

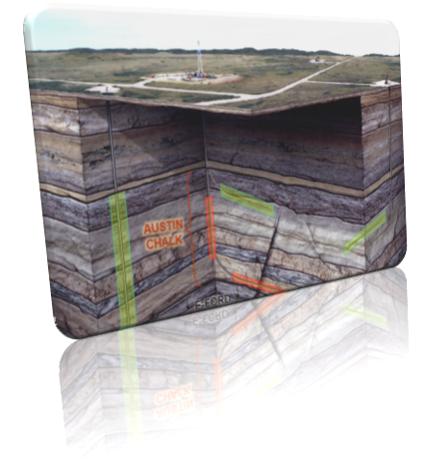

AUSTIN CHALK ASSET

Texas, United States

-

Determine value of latest unconventional gas acquisition by New Ventures Team

-

Literature and analogue research, analysis of geology, reservoir and production data, and economic calculations to determine NPV and IRR, as well as other key economic indicators.

-

Successful acquisition of key asset of interest

Notable points on the AUSTIN CHALK project

Detailed geological analysis helped identify additional value (oil legs)

Automated DCA created to optimize current and future valuation processes

Implemented leading technology in field development plans and commenced strategic discussions with midstream/downstream partners

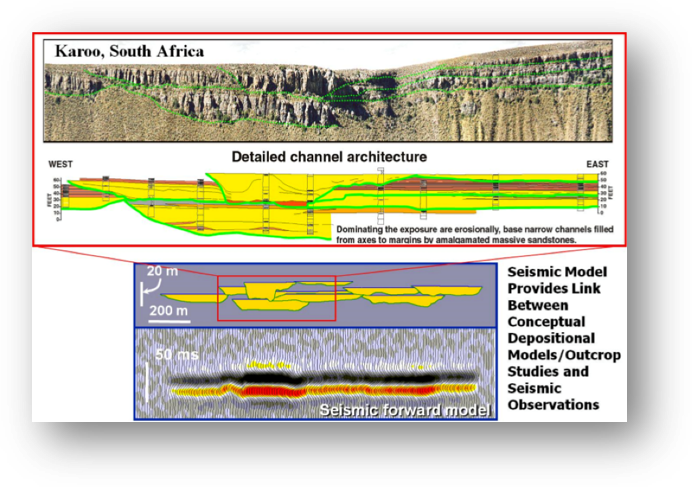

ALBA WORLD-CLASS RETROGRADE GAS STUDY

Malabo, Equatorial Guinea

-

Represent an improved understanding of Alba in a geo-model, and determine asset value and development plans

-

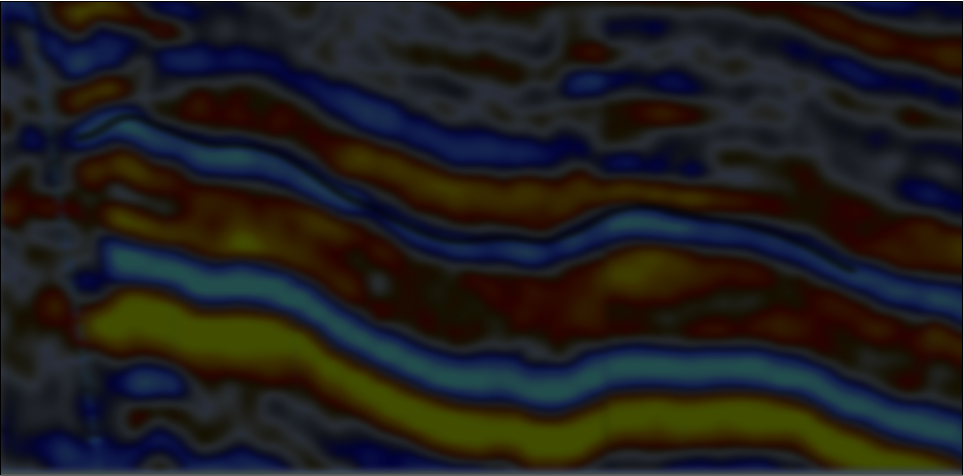

Integrated project team with geology, geophysics, reservoir disciplines. Organization and in depth review of production data, well tests, and lab oil sample analysis

-

Over $300 million additional NPV identified. Successful drilling of additional well occurred shortly after the study.

Notable points on the ALBA project

7 TCF reservoir (asset is about 30,000 acres – that’s over 22,000 football fields!)

Complex fluid system and geological structure

Successful integrated, multidisciplinary study involved addition of billion dollar LNG facility with three production platforms

Key company asset totaling up to about 40% of company revenue some times during operation of asset

EAGLE FORD VALUATION

Texas, United States

-

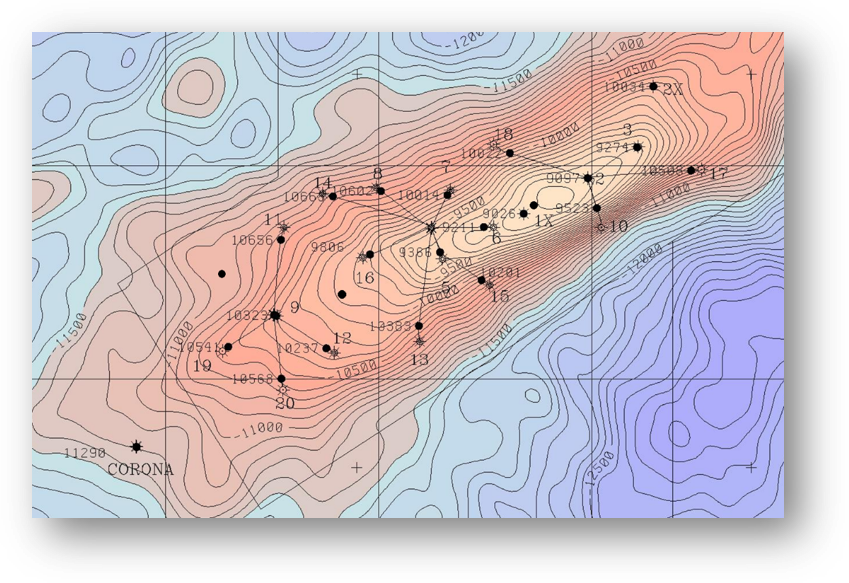

Determine EUR for various development scenarios and value acreage throughout various areas in asset

-

Intense, voluminous reservoir engineering, and history matching and simulation effort to perform high quality valuation that’s comprehensive and thorough, YET very efficient

-

Successful $3 Billion acquisition of key areas of interest

Notable points on the EAGLE FORD VALUATION

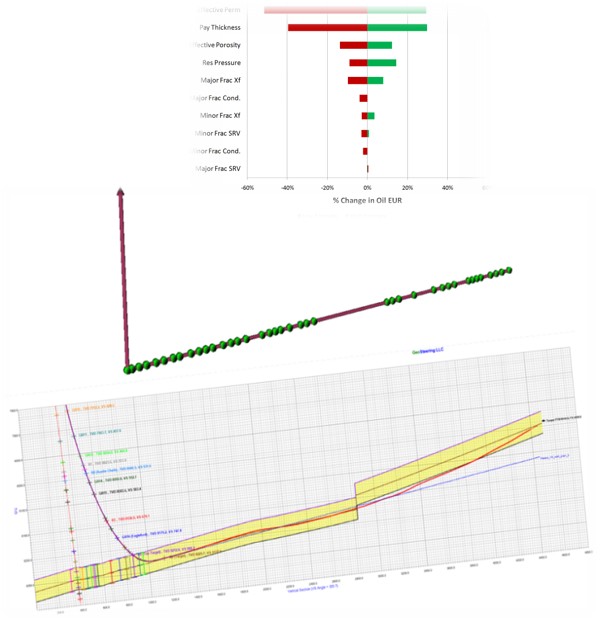

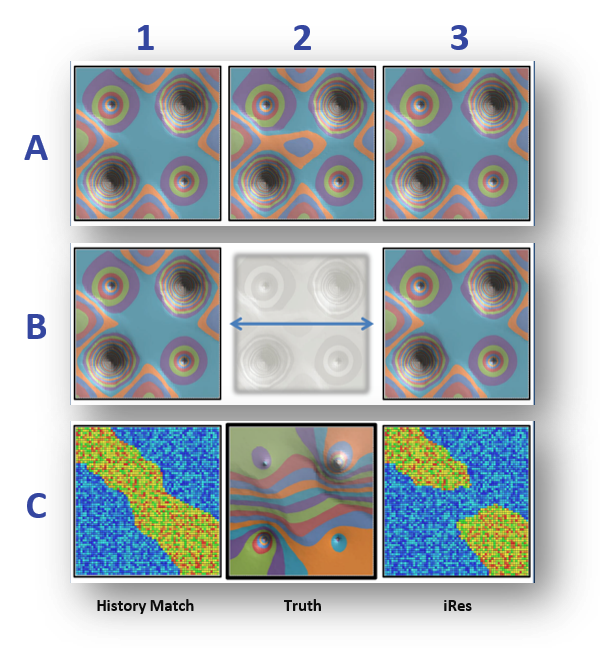

Developed an automated history matching tool, planned to be integrated with Schlumberger PETREL RE algorithm (reduced 2 years of work to 5hr 45 min)

Multidimensional sensitivity analysis to determine high risk factors

Delivered the client’s first, robust in-house geo-model for the asset

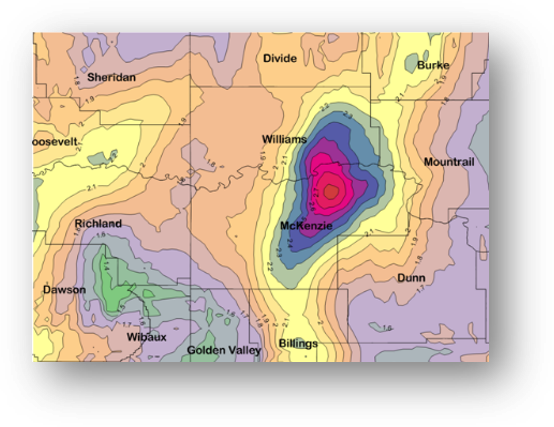

BAKKEN VALUATION

North Dakota, United States

-

Determine the value of acreage across the play

-

GOR Analysis, PVT analysis, custom automated smart analysis of massive well data sets, property modeling, and more

-

Helped the reservoir engineering team make critical decisions on valued acreage to keep, acquire, sell

CANADIAN OIL SANDS VALUATION

Alberta, Canada

-

Improvement to heavy oil production while investigating acquisition of asset with tar sands and bitumen deposits

-

Reservoir simulation of SAGD and ES-SAGD production, history match / forecast, reserves and economic analysis

-

Influenced successful acquisition of over $20 billion of Canadian oil assets

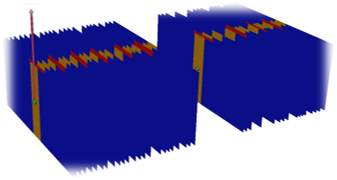

GHAWAR/POWERS SIMULATION ENHANCEMENT

Saudi Arabia

-

A system integrating use of field well pressures & HM processes to better understand the reservoir

-

Custom numerical simulation developed, utilizing new algorithms and enhancement to traditional transport physics equations. Modifications were made to POWERS to adapt to new formulations in order to improve history matching, forecasting, and more.

-

Provided patentable approach with better pressure solutions

More Engineering Consulting and Application Development Projects